Child Tax Credit For 2024 Tax Year – The child you’re claiming the credit for was under the age of 17 on Dec. 31, 2023. which helped drive child poverty to a record low Jan. 29 According to a Washington Post report . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit For 2024 Tax Year

Source : itep.org

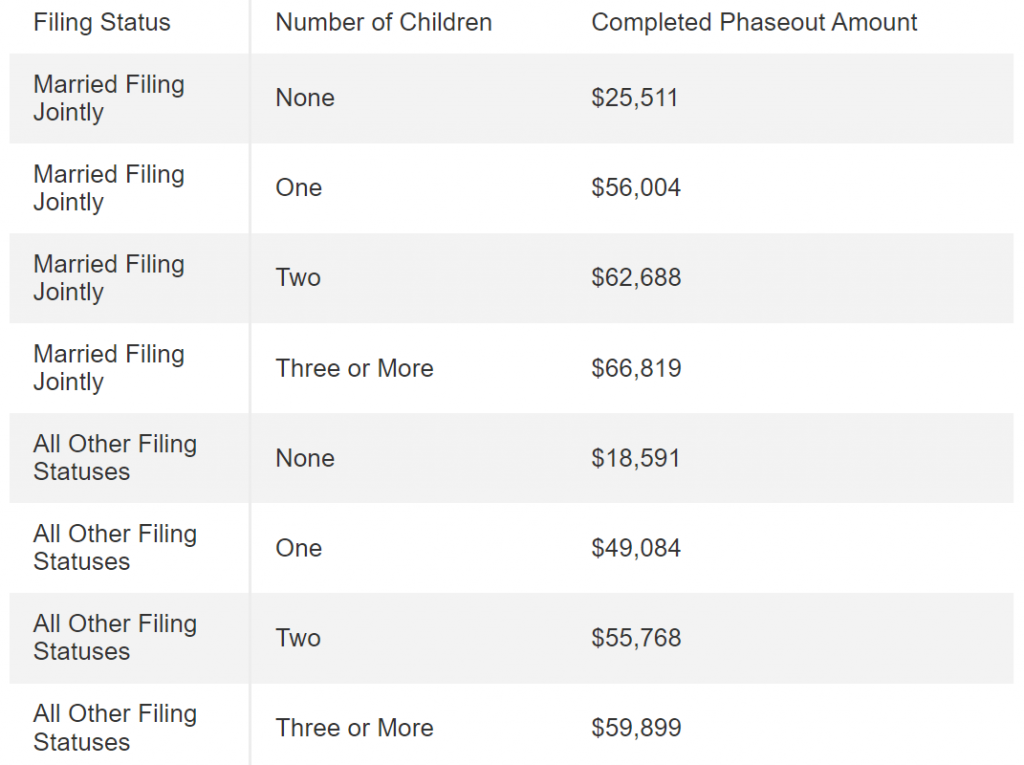

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

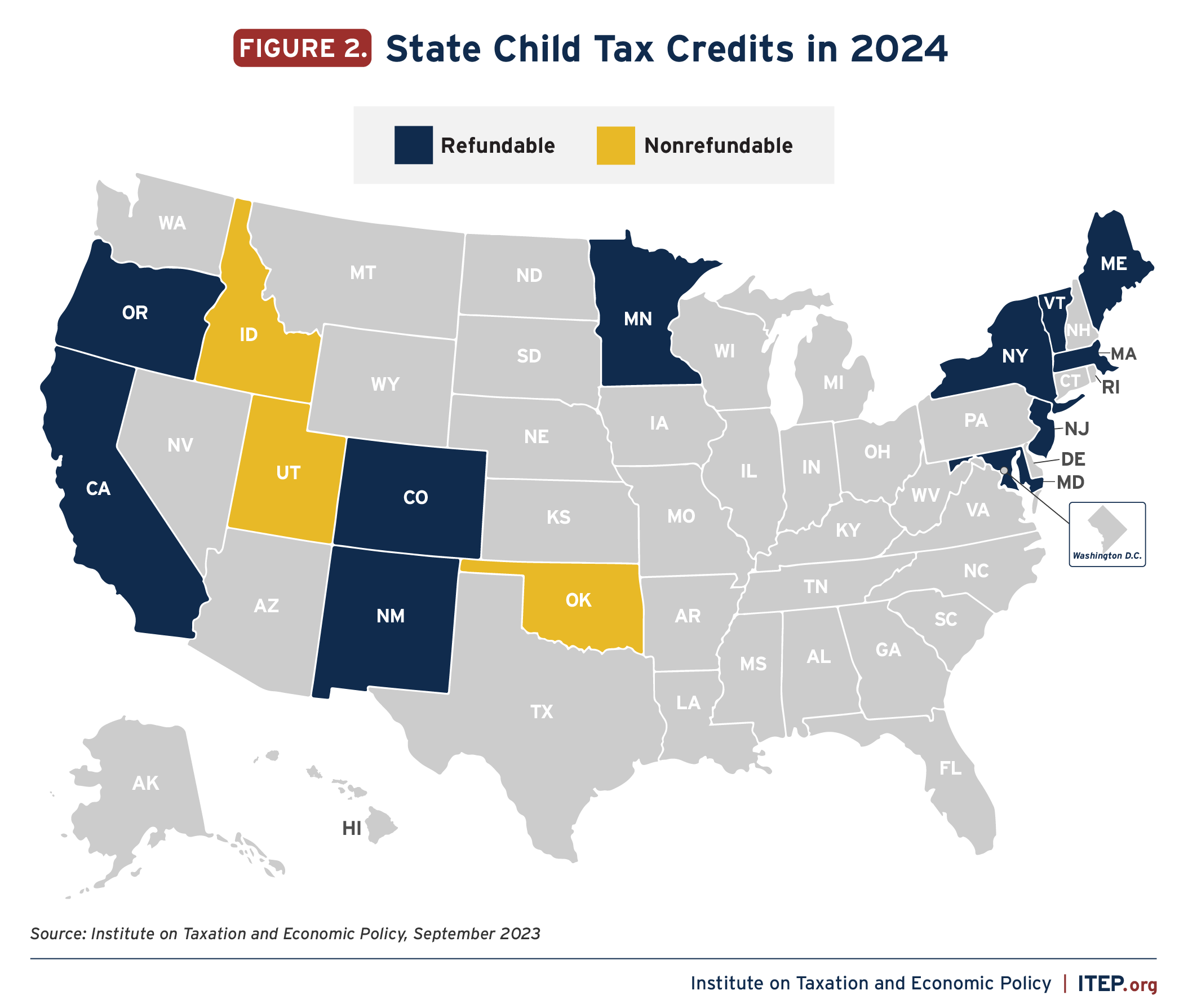

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

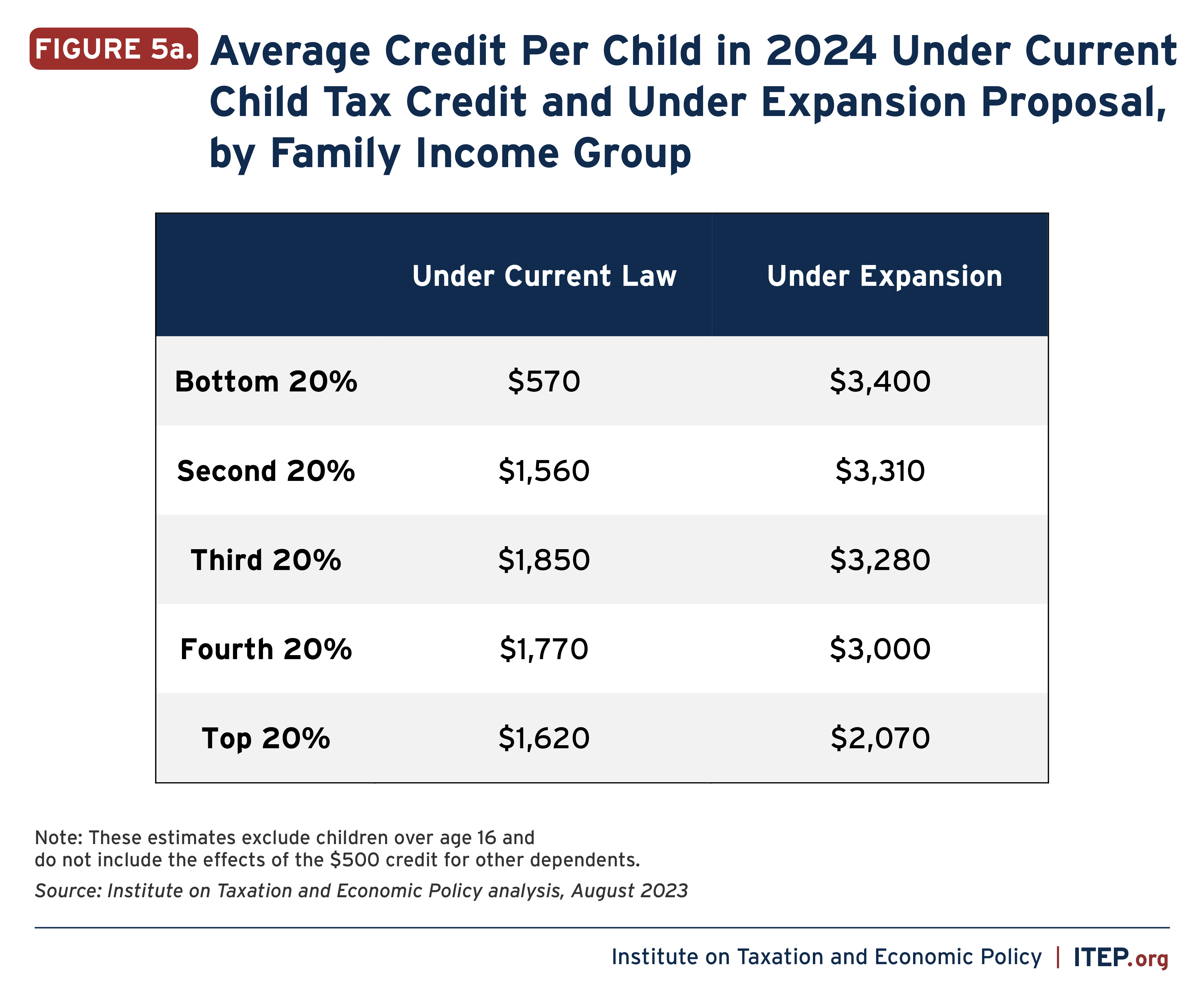

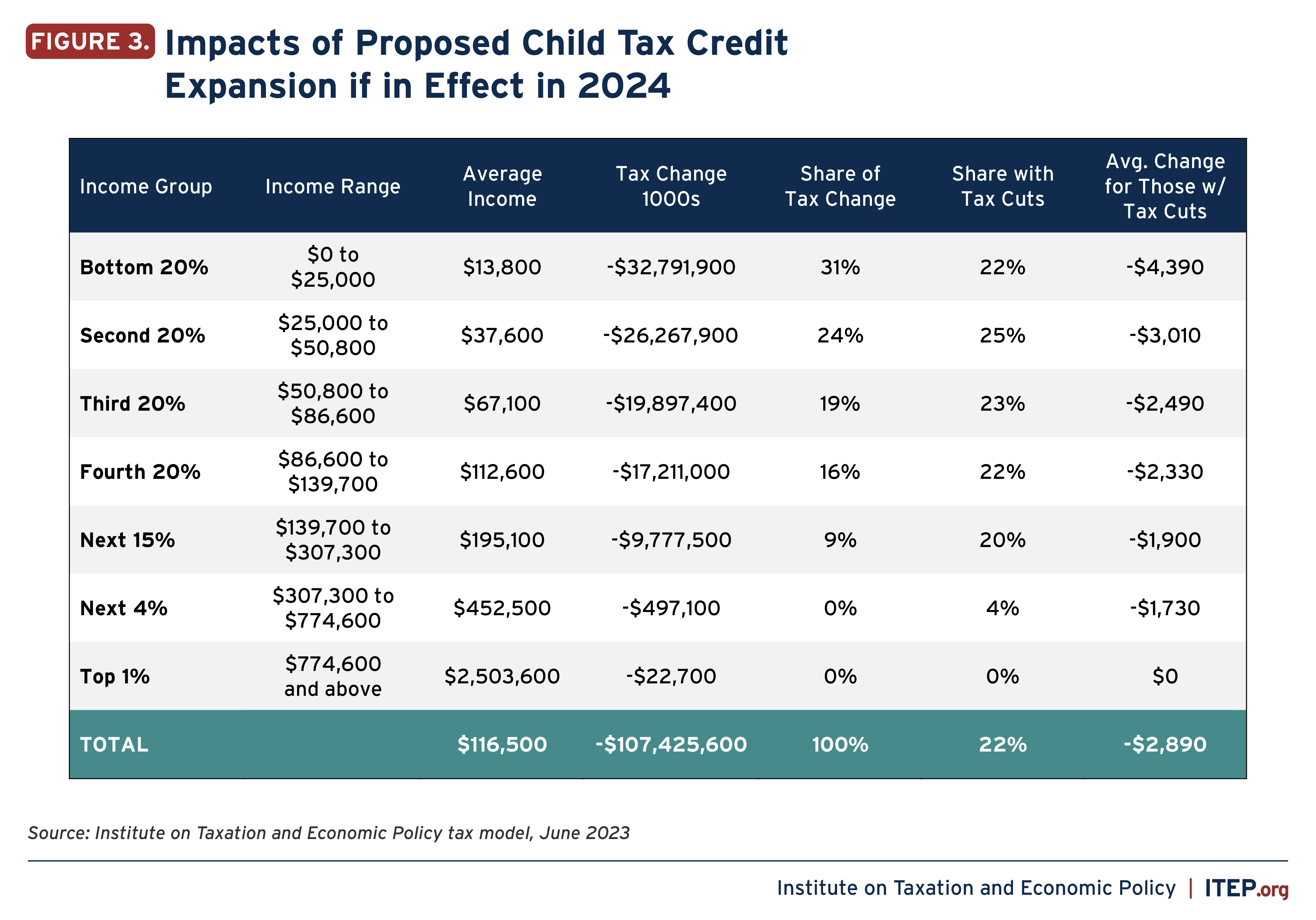

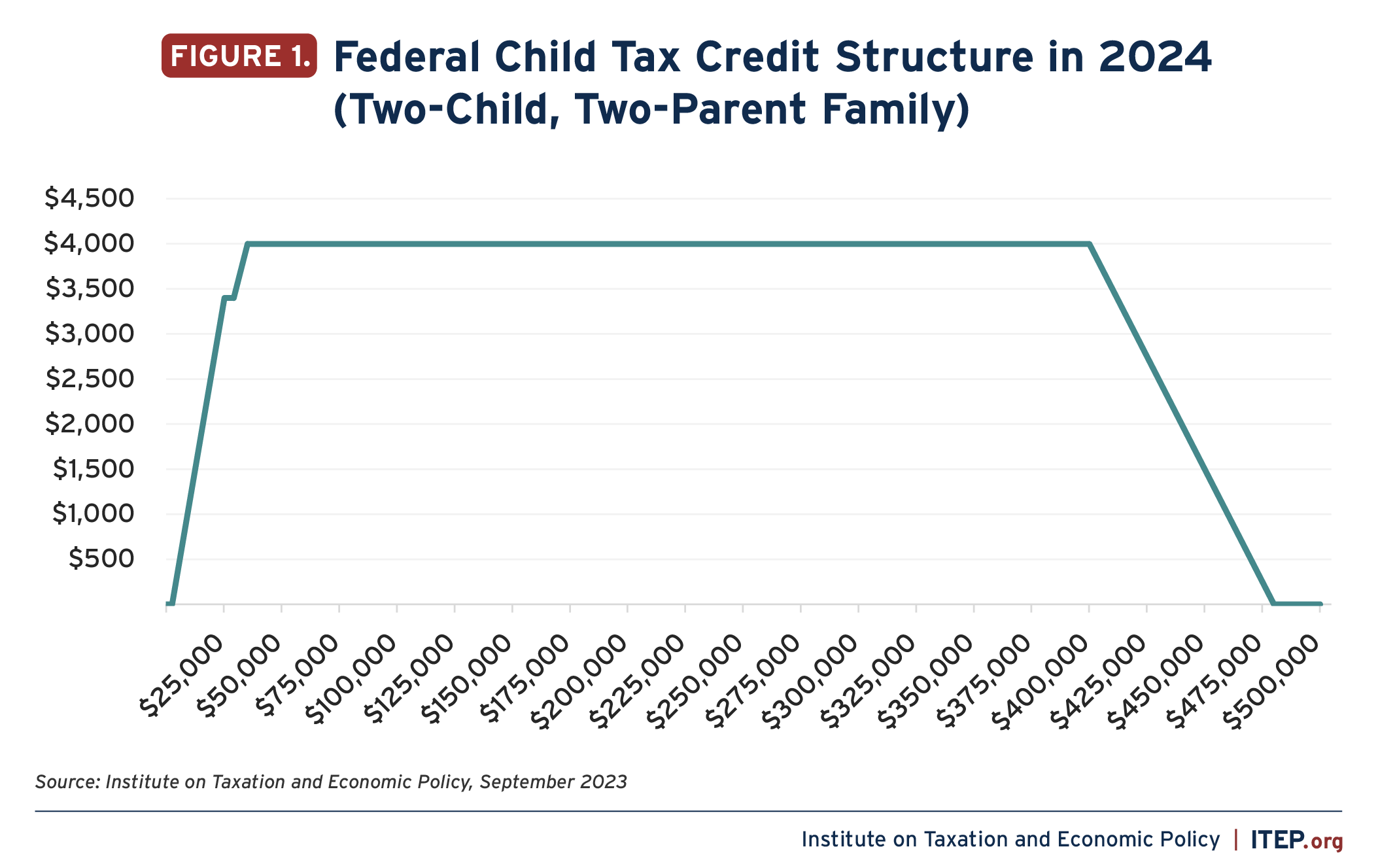

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2024: How much you’ll get per child this year

Source : www.marca.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Child Tax Credit For 2024 Tax Year Expanding the Child Tax Credit Would Advance Racial Equity in the : Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. . A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)